Case Study

The Byers House: How Fractional Ownership Turned a Stranger Things Home into a Viral Investment

Team Airevest

•September 18, 2025

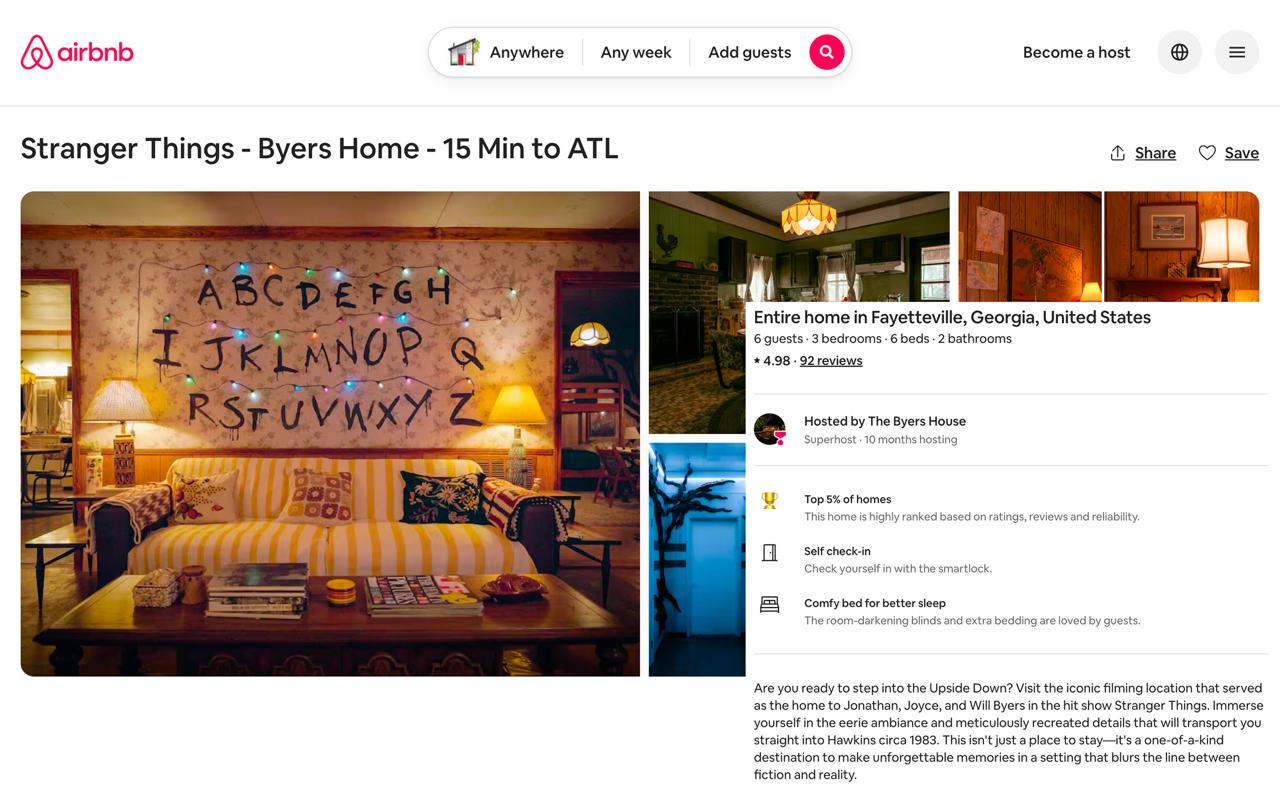

Discover how the iconic Byers House from Stranger Things became a viral fractional real estate investment, generating 9.5% net yield and attracting 6,924 investors. A deep dive into the numbers behind pop culture real estate investing.

The Byers House: How Fractional Ownership Turned a Stranger Things Home into a Viral Investment

See the Byers House on: Airbnb

Fractional real estate investing isn't just finance; it's also storytelling. Sure, it's a hedging mechanism against inflation; and yes, it gives you access to properties you can't otherwise buy on your own (and perhaps not even with a heavy financial leverage). But there's something more powerful than just accumulating wealth and assets –– the collector's mindset.

Investors don't just buy bricks and mortar –– we buy into ideas, histories, communities, and futures. That's why one of the most striking examples of this model's power comes from a pop culture icon: The Byers House from Netflix's Stranger Things.

From Hawkins to the Marketplace: The History

In 2022, the team at Arrived, a U.S.-based fractional real estate platform backed by Jeff Bezos and other major investors, spotted an unusual opportunity. Stranger Things had become a cultural juggernaut, and the original Byers family home in Fayetteville, Georgia –– the set of many iconic scenes –– was up for sale for $400,000.

Instead of leaving it to a wealthy private buyer, Arrived decided to fractionalize it. The idea: turn the property into an experiential vacation rental, where fans could book overnight stays, and thousands of small investors could co-own a piece of TV history.

The move wasn't just about yield –– it was about creating buzz. "Our goal was to create a one-of-a-kind experience that could deliver strong returns for investors and showcase how Arrived empowers individuals to invest in projects that might otherwise be out of reach," the co-CEO Ryan Fraziers said (LinkedIn, 2025).

Inside the Investment Memo

The Byers House was undeniably a cultural and marketing win, but let's check the investment memo.

- Purchase price: $400,000

- Renovation, design, and reserves: $727,159

- Closing, offering, and holding costs: $87,989

- Total project size: $1.235M

That means the cost to renovate and furnish the property was nearly two times the acquisition price. For investors, this raises the obvious question: is the value uplift really worth it? In EU markets, renovation costs are typically a fraction of property value. Here, the math looks reversed.

$500 cap due to high demand, massive investor pool.

Arrived marketed this deal to 6,925 investors. Thousands of small

shareholders signed up and wanted to owning fractions of a single house.

The scale worked for Arrived, but did it for investors?

D-day Launch Results: Viral from Day One

The Byers House launched on Halloween 2022 –– the perfect date for a haunted, nostalgia-laced property like this. The response was immediate and overwhelming:

- 6,924 investors piled in, maxing out the $500-per-investor cap.

- Within two months, the house generated $62,000 in owner revenue from 112 nights booked.

- $227k revenue in 9 months

- 99% occupancy

- Every guest rated it five stars, putting it in Airbnb's top 5% of homes globally.

- Over 10,000 new signups flooded Arrived's platform, with 1,500+ first-time investors.

- The house attracted coverage in The Hollywood Reporter, Daily Mail, MSN, TMZ, Business Insider, and more.

- Viral TikTok and Instagram posts featuring the house reached millions of viewers, turning investors and guests into the platform's biggest promoters.

It wasn't just an investment; it was an event.

Did It Work?

Oh, yes! Investors on Reddit just creamed their pants. Over 60% of Byers investors went on to back other properties, proving the power and sexiness of the platform.

Was the Byers House a marketing stunt? At AireVest, we went and crunched the numbers.

Behind the Investment Memo

We can see most of the fees posted on the investment memo, but little to do with Operating Expenses and, based on our experience having run Airbnb properties, these tend to be quite high in the short-term rental industry (commissions, multi-channel property management systems, property operators, cleaning & maintenance, etc.). Let's do the math:

🏗 CapEx (urgh...)

- Purchase price: $400,000

- Renovation, design, and reserves: $727,159

- Closing, offering, and holding costs: $87,989

- Total project size: $1.235M

📉OpEx(Annualized) (urgh x2 ...)

| Item | Amount |

|---|---|

| Gross Annual Income (Airbnb) (~$25k/mo, $850/day) | ~$300,000 |

| Arrived Fee (5% of gross rents) | $15,000 |

| Airbnb Commission (15.5%) | $46,500 |

| Property Management incl. cleaning (~30%) | $90,000 |

| Total Operating Expenses | $151,500 |

💵 Income

| Item | Amount |

|---|---|

| Net Income Before Tax | $148,500 |

| Tax (21%) | $31,185 |

| Net Income After Tax | $117,315 |

Key Metrics

| Item | Value |

|---|---|

| Initial Investment | $123,500 |

| Annual Dividend (after tax) | ~$11,732 |

| Net Yield | ~9.5% |

| Time to Break Even (via dividends only) | ~10.5 years (faster if nightly rates rise with 1--3% inflation) |

| Future Property Value (10yr hold, 3% appreciation) | ~$1.66M |

| Investor's Share of Appreciation | ~$42,474 |

| Approximate 10-Year IRR | ~8.7% |

Seems like this thing actually rests on strong fundamentals. Even with renovation costs nearly twice the purchase price and multiple layers of fees, the property delivers a net yield of ~9.5% after tax. That's well above average rental yields in both U.S. and EU markets. An investor holding 10% of the house would see ~$11,700 in annual dividends and an estimated 8.7% IRR over a 10-year horizon, assuming modest 3% appreciation. In other words, this was more than a pop culture stunt ––- it was a solid income-generating asset with portfolio-grade returns.

What We Learn from the Byers House

Well, for starters, that approximately 7000 people can tell their buddies "Yo, I own that sh*t!" Anything else? Yessir, there are 7000 people out there who earn 10% ROI on whatever they invested a couple years back.

"Is it a novelty offering? Of course! Will it ever cash flow or make $? Who knows... But I figured that spending that $100 on the Byers is a better spend (for me) than buying 10-12 fancy Starbucks coffees. The fun of the Byers purchase will be with me far longer than those expensive coffees would!"

This one turned out to be a winner.

Is there a downside?

Sure, doesn't everything?

Can you resell your share? Nope (uh-oh...)

Not really –– Arrived isn't designed for active reselling the way a stock market or AireVest model is. And that liquidity problem is not a small feat. One of the largest problems in the real estate industry is that the asset is highly illiquid (and has always been such, until recently). It's one of the fundamentals that will eventually change. Fractional ownership works best when it combines the excitement of access with the confidence of structure.

Who cares?

Well, we do, but so what? We run our own platform here now, so we can play by our own rules.